ARMD tool insurance

ARMD Tool Insurance that's fit for purpose and gets you back up and running quickly if you suffer a loss.

- 24/7 van cover at no additional cost

- Your tools can be covered if using a company vehicle

- Quick claim settlement with our 5 day claim promise*

- Also for employees with their own tools

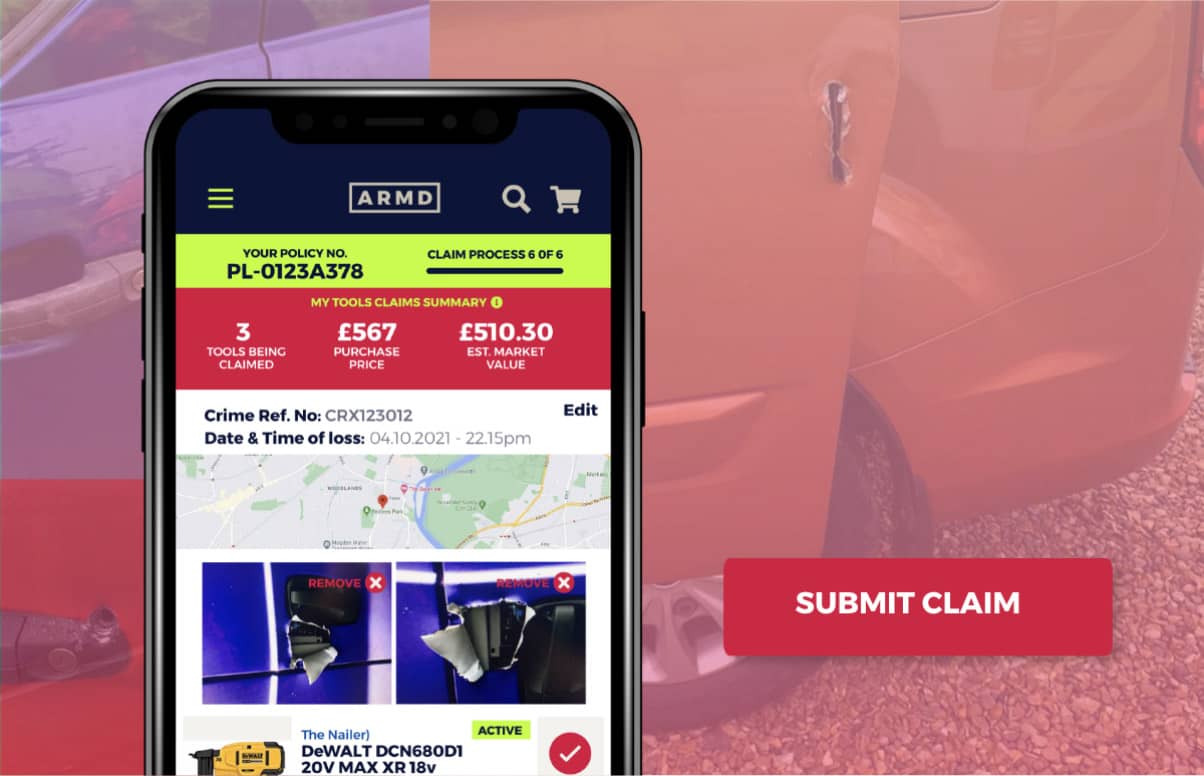

Self-service Digital Claims

Submit claims easily at the touch of a button without having to talk to the insurance company.

- Guides you step-by-step through the process to ensure the claim is complete.

- Save time by not going back and forth with the claims handler.

- Auto-calculates the claim value based on tools selected from inventory.

Featured In

News Worthy Tool Insurance

ARMD Helps trade business recover from smash and grab raid

"I just submitted my claim via the App listing all the tools from my inventory that were missing, went on holiday... It was a really smooth process and from submitting the claim to getting the money took less than a week."

Joiner gets tools just 72 Hours after tool theft

"I don't think any other insurance company would pay this quick. I recommended ARMD to the lads at work who could not believe how fast it was paid."

Award-Winning

-

@mjtiff_plumbingandheating

@mjtiff_plumbingandheating -

@rdaviselectrical

@rdaviselectrical -

@PBPlumber

@PBPlumber -

@shes_electricx

@shes_electricx

ARMD tool insurance benefits and exclusions

This product is for Permanent U.K. residents who are Tradesmen, Mini-Fleet & Fleet Owners/Operators who would like cover to protect their tools for up to GBP 10,000 for cover in transit, whilst loading and unloading and whilst stored securely overnight.

Benefits

- Theft, loss, damage, and fire cover for business tools while being loaded, unloaded, or carried in the insured's vehicle, or while stored in a locked building or purpose-built store.

- The cover is based on the market value of each item, so insureds' only pay for the cover required.

- It allows specified items to be listed and recorded in an app which assists in the event of a claim.

- Goods used for demonstration purposes are included.

Exclusions

- Theft from vehicle if not properly secured and items are out of sight.

- Hired in equipment.

- Deliberate or intentional acts.

- Damage while tools are in use.

- Theft or damage to your own personal effects.

- Wear and tear.

- Theft or damage without evidence of forcible and violent entry.

- General policy exclusions and excesses, detailed in the policy documentation.

This product is NOT for Hobbyists/DIYers, Non-U.K. residents.